Our group has been fully invested in this strategy with our paper money account for nine months now, and we finally have enough data to start doing our quarterly performance analysis. Here are the results so far.

General Notes

- This analysis is at the account level. It includes the actual positions as well as the unused cash that is sitting on the sidelines.

- Our benchmark for this account (SPY) has been updated to reflect dividends. There were 3 dividends during this period that totaled $2.35.

- $0.838 (September)

- $0.980 (December)

- $0.824 (March)

- Gross returns are shown for reference, but the analysis focuses on net returns. All returns include commissions and fees. Net returns exclude weekly deposits.

Absolute Returns

This is the return that an asset achieves over a certain period of time. This measure looks at the appreciation or depreciation (expressed as a percentage) that an asset - usually a stock or a mutual fund - achieves over a given period of time.

- Absolute return over the past 9 months was 59.57%

- Benchmark absolute return was 16.57$

- On an absolute basis, we beat our benchmark by 42.99%

- Annualized, we beat by 57.32%

![[image%255B3%255D.png]](http://lh5.ggpht.com/-pFVzZJy9b6s/U0BI5atXVtI/AAAAAAAABXo/5dDdLNusowE/s1600/image%25255B3%25255D.png)

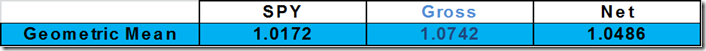

Geometric Mean

This is calculated returns a monthly mean/average. The main benefit to using the geometric mean is that the actual amounts invested do not need to be known; the calculation focuses entirely on the return figures themselves and presents an "apples-to-apples" comparison when looking at two investment options.

- Our geometric mean was 1.0486 (+4.86%) for this period.

- Our benchmark was 1.0172 (1.72%)

- On a monthly basis, we beat our benchmark by 3.14%

- Annualized this is a 37.7% beat

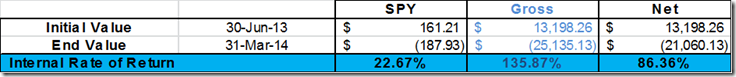

Internal Rate of Return (IRR)

IRRs can be compared against prevailing rates of return in the securities market. If a the IRR is less than the returns that can be generated in the benchmark, it may be wiser to simply invest in the benchmark.

- The IRR of our strategy was 86.36%

- Our benchmark IRR was 22.67%

- We exceed our benchmark IRR by a multiple of 3.81

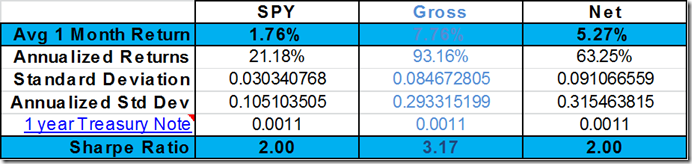

Sharpe Ratio

The Sharpe ratio tells us whether a portfolio's returns are due to smart investment decisions or a result of excess risk. Although a portfolio can reap high returns, it is only a good investment if those higher returns do not come with too much additional risk.

- The Sharpe ratio for our account is equal to our benchmark.

- This indicates that our returns were achieved at a risk level that is similar to that of our benchmark

Summary of Results

- We are beating our benchmark on all measures, while maintaining a similar level of risk.

- We are on track to beat the long term goal of growing this account to $500k by the end of 2018.

- The risk for achieving this goal is that the market stays flat or is down.

- Currently the plan to offset this risk in a down market is to use short synthetics that can be held even if the market goes bearish.

- We are analyzing a plan to use bear call verticals to increase returns during flat markets.

- With rolls, these positions can evolve into short synthetics

- If the market climbs unexpectedly, the short call can be rolled out and up and the long call left to grow.