With 2014 now behind us, it’s time to go through the performance analysis for our group's Synthetic Stock account. Before getting into the details, I wanted to discuss how the average monthly returns are calculated for the Absolute Returns and the Sharpe Ratio. There are two ways one might calculate the average monthly return – take the percentage for each month and average them out, or take the percent return between the starting and ending balances and divide it by the number of months. I am using the latter method because it makes more sense to me… I suspect that either method is fine, but if the numbers are used for analyzing future projections, be aware that the results will be less reliable with the former method.

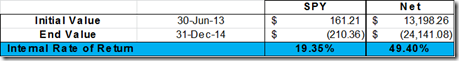

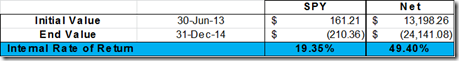

So starting with the basics, here is a look at our absolute returns compared to SPY. Since we started this account back in June of 2013 we’ve seen a return of almost 83%. That work%s out to a monthly average of a little over 4.6% or an annualized average a little over 55.2%. As I’ve pointed out during other quarters, the comparisons to our benchmark include dividends paid to the benchmark. The net results contained here don’t include deposits that we make to our paper-trading account.

So starting with the basics, here is a look at our absolute returns compared to SPY. Since we started this account back in June of 2013 we’ve seen a return of almost 83%. That work%s out to a monthly average of a little over 4.6% or an annualized average a little over 55.2%. As I’ve pointed out during other quarters, the comparisons to our benchmark include dividends paid to the benchmark. The net results contained here don’t include deposits that we make to our paper-trading account.

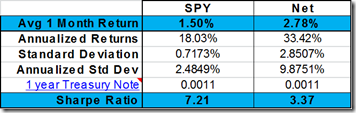

The Geometric Mean is a useful method of getting a direct comparison of investment choices. Here I’ve shown that, using this method of comparison, the synthetic strategy that we are using is outperforming our benchmark reasonably strongly (about two times on a monthly percentage basis: 1.49 verses 2.90). To look at this a little differently, consider the chart below, which shows the running monthly average returns compared graphically for the past eighteen months.

The Geometric Mean is a useful method of getting a direct comparison of investment choices. Here I’ve shown that, using this method of comparison, the synthetic strategy that we are using is outperforming our benchmark reasonably strongly (about two times on a monthly percentage basis: 1.49 verses 2.90). To look at this a little differently, consider the chart below, which shows the running monthly average returns compared graphically for the past eighteen months.

The Internal Rate of Return is a good method of comparing returns that allows withdrawls and deposits to be taken into consideration. Even though we probably won’t be simulating using this account for monthly income for a few years, I still include it as a method for comparison since so many like to use it. The IRR is showing that we’re outperforming our benchmark by a little more than two times.

The main benefit achieved from analyzing the Sharpe Ratio is understanding the comparative amount of risk taken. The higher the Sharpe Ratio, the better. For this strategy, we already know that our risk is higher than our benchmark because we are using the leverage offered by options to achieve our results, so our Sharpe Ratio is going to reflect that with a lower calculation than our benchmark. The Sharpe Ratio calculations also include the standard deviation from the monthly mean is about 2.88%, so we can expect our monthly return to be in the area of 1.73% to 7.49% most of the time.

With only 18 data points, we are getting to a level where the standard deviations are statistically relevant, but we aren’t quite there yet. As it stands, we have a few months that easily fall outside of three standard deviations. This tells us that either our data does not fall within a normal curve, or we still need a couple more years of returns to build this data set.

All in all, I am still happy with the results of this strategy so we’ll continue working with it in 2015. I’m bullish for the coming year, but I think we will have a pullback that is in the 10% range. Not to worry, our plan includes a method for profiting during the pullback when it does finally come. In the meantime, good luck in the new year!

Our geometric mean shows us a little more of an equal comparison than our absolute returns. Here you can see that we are still outperforming over the past 7 months, but it has fallen to about .about a .7 difference while last quarter it was nearly 2. This is also obvious on the trend comparisons of our average monthly returns.

![[image%255B3%255D.png]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEh3Bu8iAsH7D-8gHUMJqgMTCaypN9lFfIB6_LQZ6UrarjeA6dgdaecNGtGEpZzRNrjEm-QhfPS8rQV1I3uqP7f_HStMlD77j6Lnt9DvHLuAevzFTVC8bjAEzi74RYpIL4McE63uJQqHr_cj/s1600/image%25255B3%25255D.png)